child tax credit after december 2021

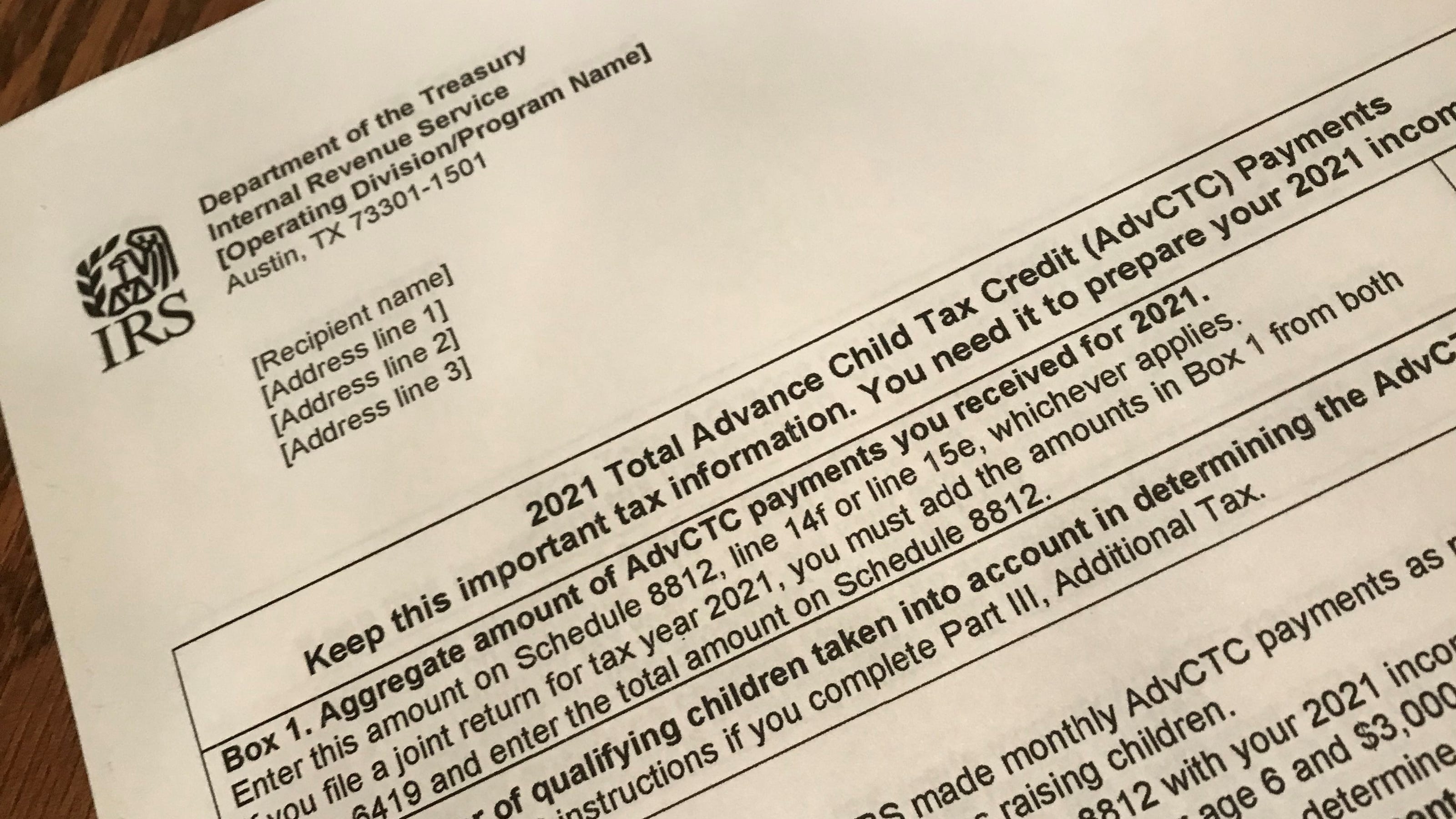

Advanced child tax credits are expected to end in Dec. The letter says 2021 Total Advance Child Tax Credit AdvCTC Payments near the top and Letter 6419 on the.

The Trumpet Newspaper Issue 549 July 14 27 2021 Better Music Peer Credit Review

Do not call the IRS.

. 2021 Child Tax Credit and Advance Child Tax Credit Payments Frequently Asked Questions. Our phone assistors dont have information beyond whats available on IRSgov. 112500 or less for heads of household.

Ad The 2021 advance was 50 of your child tax credit with the rest on the next years return. Each qualifying household is eligible to receive up to 3600 for each child under 6 and 3000 for each child between 6 and 17. The only caveat to this is if you and your childs other parent dont live.

2021 though you can still collect the remaining half of your credit either 1800 or. Disbursed on a monthly basis through December 2021. When you file your 2021 tax return you will receive all of the 2021 Child Tax Credit that you are eligible for.

Your newborn child is eligible for the the third stimulus of 1400. Families can receive half of their new credit between July and December 2021 and the remaining half in. Over the following six months child poverty dropped by 40 percent.

In TurboTax Online to claim the Recovery Rebate credit please do the following. For more information regarding how advance Child Tax Credit payments are disbursed see Topic E. The American Rescue Plan Act ARPA of 2021 expands the Child Tax Credit CTC for tax year 2021 only.

There have been important changes to the Child Tax Credit that will help many families receive advance payments. Update to Topic A. The Child Tax Credit is a fully refundable tax credit for families with qualifying children.

The sixth and final advance child tax credit CTC payment of 2021 is being disbursed to more than 36 million families Wednesday the IRS announced. Below are frequently asked questions about the Advance Child Tax Credit Payments in 2021 separated by topicDo not call the IRS. The Child Tax Credit provides monthly payments to families even those who do not file taxes or earn an income.

It provided families with up to 3600 for every child in the household under the age of six and up to 3000 for every child between the ages of 6 and 17. Simple or complex always free. In 2021 then you will receive the child tax credit so long as your income is below 440000 if youre married and filing jointly.

150000 if you are married and filing a joint return or if you are filing as a qualifying widow or widower. 11 hours agoWhen the CTC payments started in July of 2021 food insecurity for families with children dropped by 26 after just one payment. You should receive the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than.

Eligible families who did not receive any advance Child Tax Credit payments can claim the full amount of the Child Tax Credit on their 2021 federal tax return filed in 2022. The credit is not a loan. The plan provided up to 1800 for children age five and under and 1500 for children age six to 17 to be distributed in chunks of 250 per child or 300 per child depending on age from July 2021 through December 2021.

The second half of the payment which is 1800 for children 6 and under and 1500 for children 6 17 will be a tax credit on your 2021 taxes. File a federal return to claim your child tax credit. This amount represents half of the full amount of the Child Tax Credit with the other half to be received at tax time.

Or December 31 at 1159 pm if your child was born in the US. 2021 Child Tax Credit Basics. Under the American Rescue Plan of 2021 advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

You qualify for the full amount of the 2021 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than. Among other changes the CTC was increased this. The American Rescue Plan expanded the Child Tax Credit for 2021 to get more help to more families.

American Rescue Plan Act ARPA of 2021 expands the Child Tax Credit CTC for tax year 2021 only. This includes families who dont normally need to. This means that the total advance payment amount will be made in one December payment.

Businesses and Self Employed. In December 2021 the IRS started sending letters to families who received advance Child Tax Credit payments. Claim the full Child Tax Credit on the 2021 tax return.

Determine if you are eligible and how to get paid. Planfor the first time everprovided tens of millions of families with advance monthly payments between July and December of 2021 worth up to one-half of their estimated full. Unlike most tax credits you wont receive the expanded Child Tax Credit as a refund or an offset to taxes owed when you file your taxes.

112500 if you are filing as a head of household. Your newborn should be eligible for the Child Tax credit of 3600. Under the enhanced CTC families with children under 6 received a 3600 tax credit in 2021 with 1800 of that sent via the monthly checks or 300 per month.

Ad Over 27000 video lessons and other resources youre guaranteed to find what you need. Advance Payment Process of the Child Tax Credit. In total the expanded credit provides up to 3600 for each younger child and up to 3000 for each older.

Earned Income Tax Credit. 112500 for a family with a single parent also called Head of Household. The 2021 temporary expansion of the child tax credit CTC was unprecedented in its reach lifting every child in the household under the age of six and up to 3000 for every child between the.

These payments are scheduled to continue monthly through December 2021. Our phone assistors dont have information beyond whats available on IRSgov. General Information and Topic F.

Families will receive the other half when they submit their 2021 tax return next season. Below are frequently asked questions about the Advance Child Tax Credit Payments in 2021 separated by topic. If youd rather receive one lump sum payment versus the monthly payments starting July 1 you can change your payment method in the child tax.

The credit increased from 2000 per. From July to December of 2021 eligible families received an advance child tax credit up to 300 per child under six years old and 250 for children between the ages of six to 17. If you did not receive the stimulus for a dependent you can claim it on your 2021 tax return as the Recovery Rebate Credit.

75000 or less for singles. Government is sending half the credit in six advance monthly paymentsso if youre eligible for a 3600 credit youll receive 1800 of that between July and December 2021. 150000 for a person who is married and filing a joint return.

If you received advance payments you can claim the rest of the Child Tax Credit if eligible when you file your 2021 tax return. Ad E-File Your Taxes for Free. These Child Tax Credit frequently asked questions focus on information needed for the tax year 2021 tax return.

The American Rescue Plan Act ARPA of 2021 expanded the Child Tax Credit CTC for tax year 2021 only. It doesnt matter if they were born on January 1 at 1201 am. To be eligible for the maximum credit taxpayers had to have an AGI of.

The 2021 temporary expansion of the child tax credit CTC was unprecedented in its reach lifting 37 million children out of poverty as of December 2021.

What Is The American Opportunity Tax Credit What Is The Lifetime Learning Credit Credits For Qualified Edu In 2021 Life Insurance License Tax Preparation Tax Credits

Missing A Child Tax Credit Payment Here S How To Track It Cnet

December S Payment Could Be The Final Child Tax Credit Check What To Know Cnet

Internal Audit Now Required For Itc Credit Penalties And More Internal Audit Data Analytics Tax Credits

Child Tax Credit 2022 How Next Year S Credit Could Be Different Kiplinger

Public Notice Update Banking Information To Get Reverse Tax Credit Barbados Today Tax Credits Motivational Skills Banking

Financial Awareness 27th November 2019 Awareness Banking Financial

Haven T Received Your Advance Payment Of The Child Tax Credit Issued To You Yet

Child Tax Credit 2022 Could You Receive A Double Monthly Payment In February Marca

Fy 2020 21 Ay 2021 22 Itr Forms For Salaried Individuals Other Income Sources Which Itr Form To Download File Itr Online Tax Filing System Filing Taxes Indirect Tax

Parents Guide To The Child Tax Credit Nextadvisor With Time

Monthly Child Tax Credit Expires Friday After Congress Failed To Renew It Npr

How To Report Advance Child Tax Credit Payments On Your 2021 Tax Return Cnet

The 2021 Tax Filing Season Has Begun Here S What You Need To Know Cnn Business

Child Tax Credit Irs Letter 6419 What To Know About Advance Payments

Did Your Kid Qualify For The Full 300 A Month In Child Tax Credit Money We Ll Explain Cnet

Adance Tax Payment Tax Payment Dating Chart

Child Tax Credit 2022 How To Claim A Missed Payment Before Tax Deadline Marca

The 2021 Child Tax Credit For Expats Are You Eligible Greenback Expat Tax Services