risks associated with closed end funds

Closed-end fund historical distribution sources have included net investment income realized gains and return of capital. The SP 500 hit an all-time high but pulled back amid inflation concerns in late September finishing the quarter up 06.

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

Understanding Closed End Vs Open End Funds What S The Difference

Closed-end funds can offer advisers opportunities to.

/GettyImages-1162966566-19102c67f9424a5d9b7eb826332ed48d.jpg)

. Investors should contact a funds sponsor for fund-specific risk information andor contact a financial advisor before investing. Additionally the Financial Industry Regulatory Authority FINRA issued and Investor Alert Closed-End. Credit Risk Credit risk is the risk that the issuer of a security will default or unable to meet its obligations to pay interest or principal as scheduled.

By contrast open - end funds are characterized by the continual selling and redeeming of their units at or near to net asset value and this at the request of any unit - holder. A lthough the report did not require a. Expense ratios or the cost of owning the fund each year may also be lower compared to some open-end funds.

Trading in such portfolios requires research and analysis before such investment. What are the risks associated with Closed-end Funds. Office of Postsecondary Education Comments.

Closed-end funds continue to gain in popularity as investors hunt for yield in a yield-less world. Until the original listing of a closed-end fund on an exchange no closed-end funds shares will have a. OPE agreed with each of the suggestions.

The risks associated with this type of fund mainly include market risk and how that can affect pricing. Risks Securities in a portfolio of a closed-end fund may decline in value and the closed-end fund may not achieve its intended objective. Changes in interest rate levels can directly impact income generated by.

Shares of closed end funds in secondary markets are often accompanied by high volatility in trading. There is generally no minimum investment needed to invest in closed-end funds. They also can be subject to different risks volatility and fees and expenses.

And mitigate risks involving closed schools or schools at risk of closing that receive HEERF grants. Prices may swing from one high value to a low value point all in one days trading action. There are varying levels of risks associated with each closed end fund.

Closed-end funds have their own investment objectives strategies and investment portfolios. If stocks experience a bout of volatility then that can cause fund prices to fluctuate as well. Thats the Greenlight effect.

Why Risk Your Efforts Being Stalled Or Worse By Not Consulting A Lawyer In Time. There is an inherent risk of capital loss associated with all closed-end funds. Closed-end funds offer useful information on their websites.

There is no assurance that the recommended trustsfunds will outperform their peer group. This can be a retail product for those who can stomach the associated risks in their search for relatively high-potential income and gains. This site does not list all of the risks associated with each fund.

Download the app today. If you look at those three big risks in closed end funds. Risks of Closed-End FundsThe value of any closed-end fund will fluctuate with the value of the underlying securities and supply and demand in the secondary market.

The leverage huge expense fees and uncertainty around the discount longer-term investors are usually better off with an ETF. Consider developing and providing guidance to IHEs that close or are closing regarding use or return of HEERF funds. In addition each closed-end fund is subject to specific risks that vary depending on its investment.

The value of a. Ad We Help Establish Funds Support You Along The Private Fund Path Every Step Of The Way. Just like open-ended funds closed-end funds are subject to market movements and volatility.

The securities selected by Closed-End Fund Research could underperform comparable trustsfunds. Ad High-Dividend Stock Specialists. Closed-End Funds Offer Yield But Beware Of The Risks Closed-end funds can provide much better income yield than youd get from most bonds or certificates of deposit.

But be sure you weigh the. Closed - end funds are so - called because their capitalization is fixed or closed which implies that the supply of closed - end fund shares is inelastic. This is a significant risk for closed end bond funds as a default by one or more of the CEFs underlying bond holdings can have a significant impact on the CEFs NAV market price and ability to make distributions to shareholders.

Ad The money app for families.

/bonds-lrg-2-5bfc2b24c9e77c00519a93b5.jpg)

Open Your Eyes To Closed End Funds

What Is A Closed End Fund And Should You Invest In One Nerdwallet

What Are Closed End Funds Forbes Advisor

What Is The Difference Between Closed And Open Ended Funds Quora

What Is The Difference Between Closed And Open Ended Funds Quora

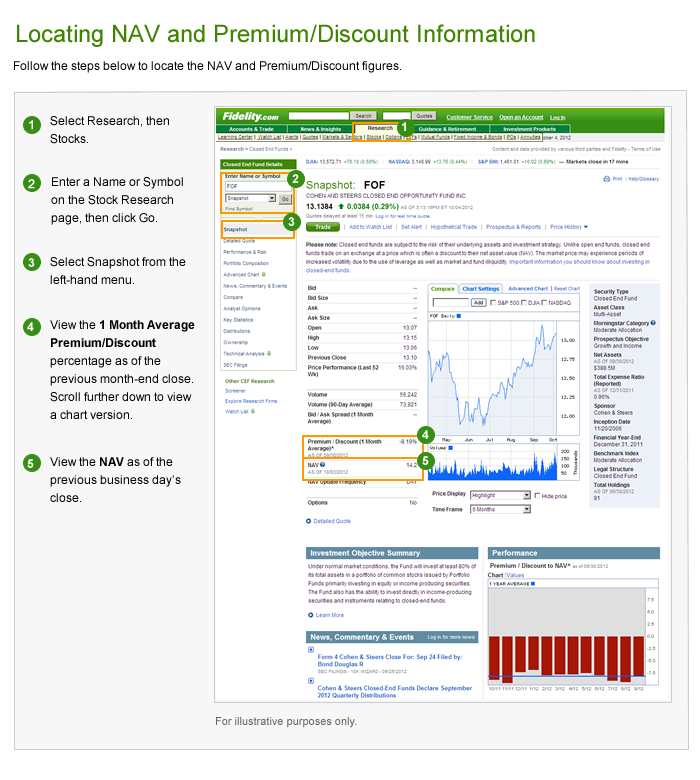

Closed End Fund Cef Discounts And Premiums Fidelity